The Groove 253 - Build (or Fix) Your Collection in 2026

Welcome to the 253rd issue of The Groove.

I am Maria Brito, an art advisor, curator, and author based in New York City.

If you haven’t done so, please subscribe here, to get The Groove in your inbox for free every Tuesday.

BUILD (OR FIX) YOUR COLLECTION IN 2023

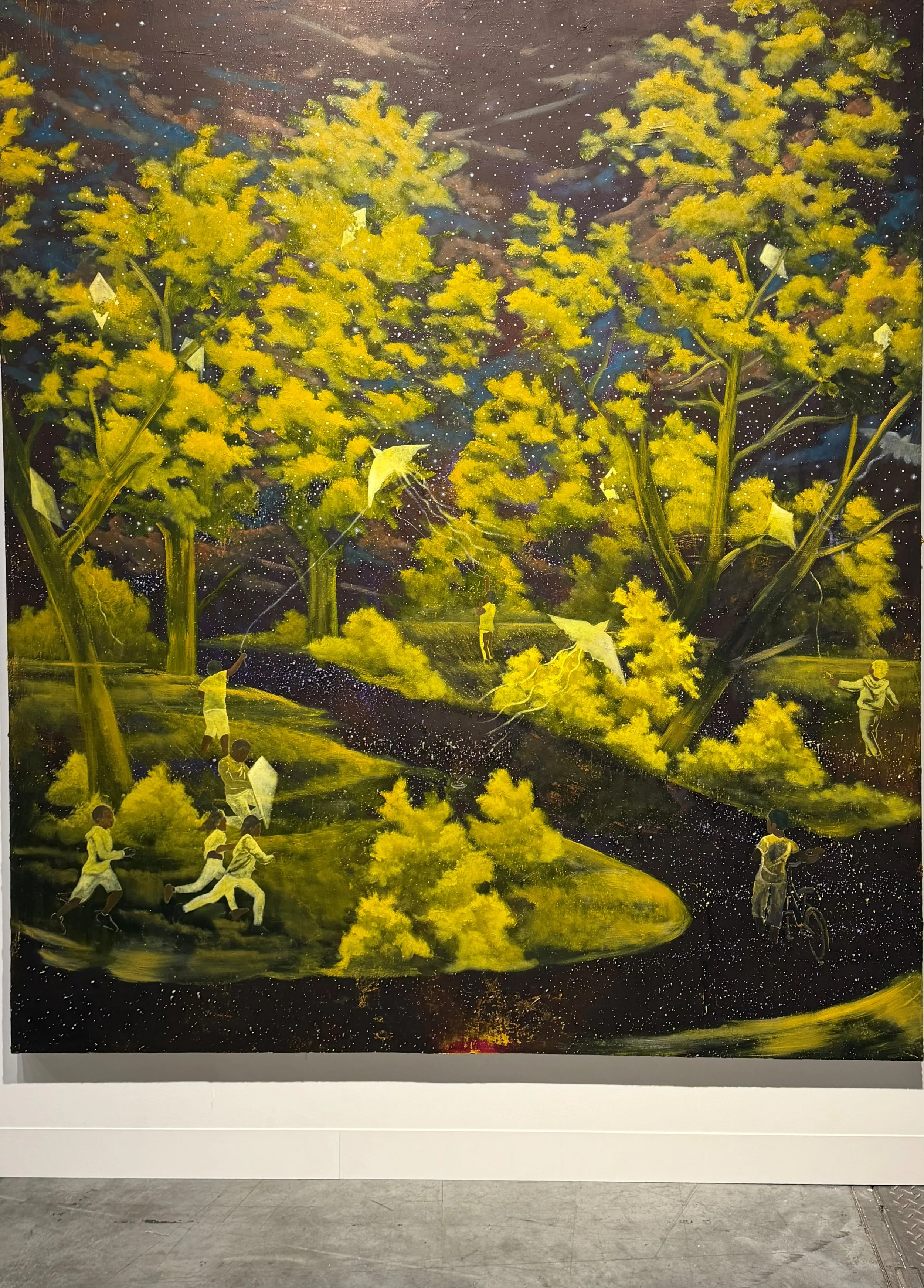

Dominic Chambers, My God, It’s Full of Stars (Interpretation 2), 2025. Oil on linen. This was one of my favorite works at Art Basel Miami Beach. It was hanging at the booth of Lehmann Maupin. It’s not too big at 84 x 72 inches. The artist has an MFA from Yale University, his work is in the collection of many good museums and I have witnessed his evolution for at least 8 years.

Miami gave me a theme. More than a few people pulled me aside to say: “I love your newsletter. I want to work with an advisor like you… but I’m afraid it’ll be expensive.”

Here’s my honest answer: it’s far more expensive to navigate this market alone. You’re looking at hundreds of serious galleries (and a thousand forgettable ones along with some tourist traps too), auction houses at every tier, spotty price transparency, a flourishing trade in fakes and “optimistic” attributions, and access that’s political even when it pretends not to be. I’ve met plenty of smart, accomplished people who built collections solo, then called me because the work no longer fits their eye, the values won’t hold, or both.

This isn’t gatekeeping; it’s risk management.

The art market is large, fast, and asymmetrical. Global sales were about $57.5B in 2024 - down 12% in value from 2023 -but with more transactions, which tells you the frenzy at the very top cooled while the real action moved to the tiers, where smart collectors actually build. That’s the lane I work in.

The Price of Going It Alone (False Economy)

The most common self-inflicted wounds I see aren’t dramatic; they’re cumulative.

Paying primary prices that are set by narrative, not evidence. Buying “hot” names in weak examples (wrong period, wrong motif, wrong scale). Treating auction comps as interchangeable without checking condition, provenance, or the strength of the work itself. And mistaking Instagram visibility for institutional momentum.

Auctions amplify this. They’re public, exciting and lined with tripwires: buyer’s premiums, guarantees, irrevocable bids, house vs. third-party interests, and catalog euphemisms. They’re terrific when you’re targeting a specific object with a ceiling and a plan; they’re costly when you wander.

Access is hard and political. Good galleries place with intent; lists exist; timing matters. You don’t have to play games, but you do need leverage, relationships, and a track record that says “this work will live well with that collector”. That’s hard to DIY on weekends.

Your 2026 Collector OS (Simple, Not Easy)

Object first. Turn the label off. Does the work hold at two feet and at twenty? Is it a strong example of what makes this artist matter: period, motif, scale? If three different examples (gallery, museum, serious private) all read clearly, you’re likely in quality.

Evidence next. Provenance, exhibitions, publications, conservation. Recent comps that are truly comparable (same period/series/scale/condition). Price coherence in today’s market, not 2022 fantasies. If anything feels “explained away,” step back.

Ecosystem last. Can this work travel: to a museum show, to a strong group exhibition, to a credible book? Who is managing supply? Is there a catalogue raisonné in motion? Where does it make sense to place and loan? Collections compound when works accrue memory: loans, citations, footnotes.

A note on the landscape: online is here to stay, but it isn’t “add to cart.” The share of online sales remains well above pre-pandemic levels, yet the bigger the ticket, the more human the process gets: emails, PDFs, video, condition, and a real conversation before the wire. Friction isn’t a bug; it’s diligence.

Where to Buy What (Primary, Secondary, Auction)

Primary (from the representing gallery). Best for artists you want to back over time. The price is the price, but the example is not interchangeable. Target right-period, right-motif works; avoid filler made to meet demand.

The younger the artist, the shorter the track record and the higher the variance. That’s the honest math. The upside is access: prices are more approachable, supply isn’t gate-kept to the same degree, and you can back real invention early. The goal isn’t to predict the canon. It’s to identify work that will still make sense to you when the cycle turns - because the image is arresting, the color language is singular, the narrative is compelling, or there’s a genuinely new turn in abstraction. You’re not buying novelty; you’re buying difference.

Lean on substitutes for proof: coherence across multiple works (not just one viral image), a lineage you can name (who they’re in conversation with), plus the twist that’s unique to that artist. Also pay attention to signs of rigor - residencies, MFAs, serious group exhibitions, and thoughtful writing by a curator, not just a press blast. Do the two-distance test (20 feet and 2 feet), the label-covered test, and the context test (see the work in at least two venues). Materials are new, so issues are rare, but still do a quick sanity check on grounds, pigments, and construction so you’re not surprised later.

Secondary (private). This is where judgment and relationships save real money. Insist on condition reports, provenance that closes, and realistic pricing against recent comps. Be allergic to reasons like “because 2022.” If you’re paying a premium, know exactly what you’re paying for - signature period, publication history, scale, a museum loan recently returned.

Auctions. Use when you need a specific historical object with clear comparables, or when you can exploit seasonality. Do the work: examine in person, read the footnotes, and set a hard walk-away bid inclusive of fees. Remember the current shape of the market: top-end fireworks are thinner; the lower and mid-tiers are active. That’s where disciplined bids win.

Make It Compound (Taste, Time, and Placement)

Collections get great when they read: a through-line of ideas, materials, places, or problems the works are solving. Pick your spine: for example, surrealism’s afterlives, spiritual abstraction, image systems, diaspora modernisms. Build depth over breadth. Focus is not narrowness; it’s coherence.

Train your eye like a muscle: museums (old and new), catalogues, studio visits, fairs, back rooms. Learn to love saying no. Taste compounds the way capital does, by letting strong decisions stack over time.

Finally, treat placement as part of value creation. Good loans build memory; good documentation (appraisals, reports, invoices, install photos) builds clarity. In a market that’s younger, more global, and more multi-channel than ever, conviction (not consensus) wins. And yes, the demographics back that up: next-gen collectors are active across categories, while overall transactions are rising even as top-end values cool. That’s a perfect setup for patient builders in 2026.

Make the Market Work for You

An advisor’s fee should pay for itself in avoided mistakes, better examples, cleaner pricing and doors that open when they need to.

Whether you’re starting fresh or refining what you have, 2026 will reward people who buy for quality and evidence. Stop shopping. Start collecting.